Guide to Using the Quantitative Model

1. Multi-Asset Model

This model helps you figure out which assets are going up or down in value. It shows you:

- Which assets are rising the most,

- Which are falling the most,

- Which have just started to rise,

- Which have just started to fall.

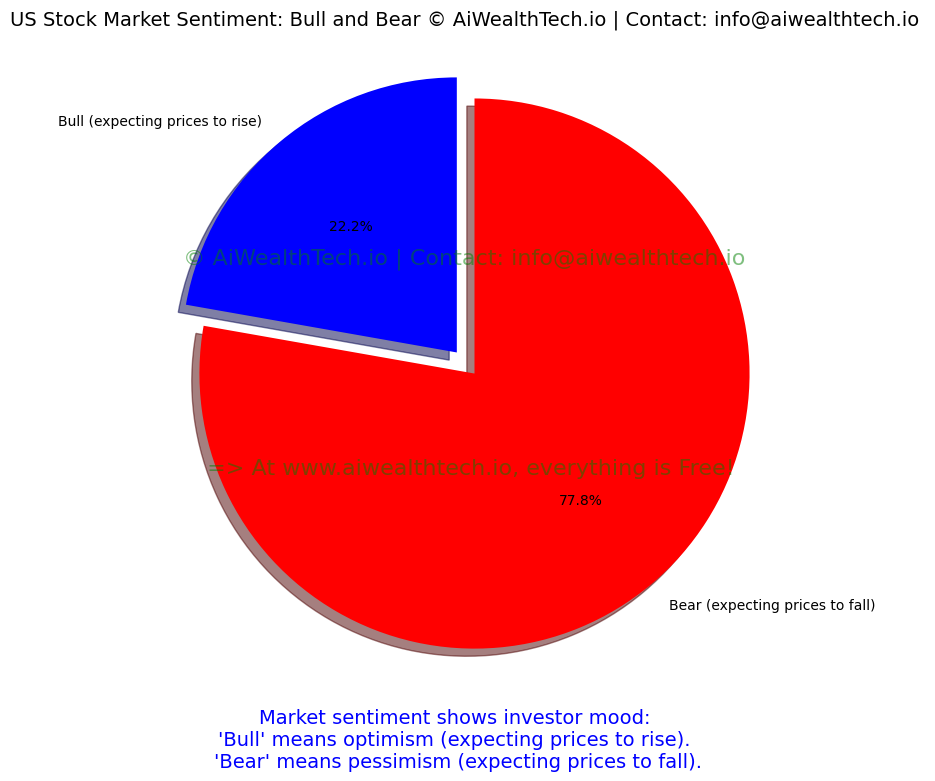

You can use this information along with market sentiment (how the market is feeling) to decide whether to buy (go long) or sell (go short).

For example:

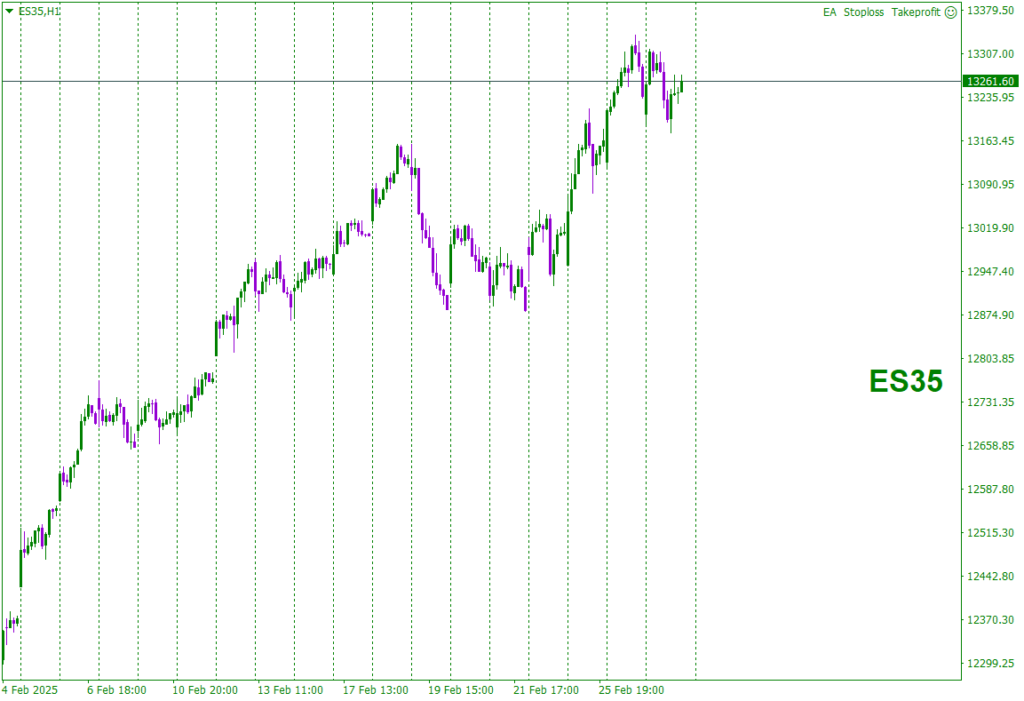

- If USBOND and ES are the strongest performers, prioritize buying them.

- If BTC and ETH are dropping the most, prioritize selling them.

For forex (currency pairs):

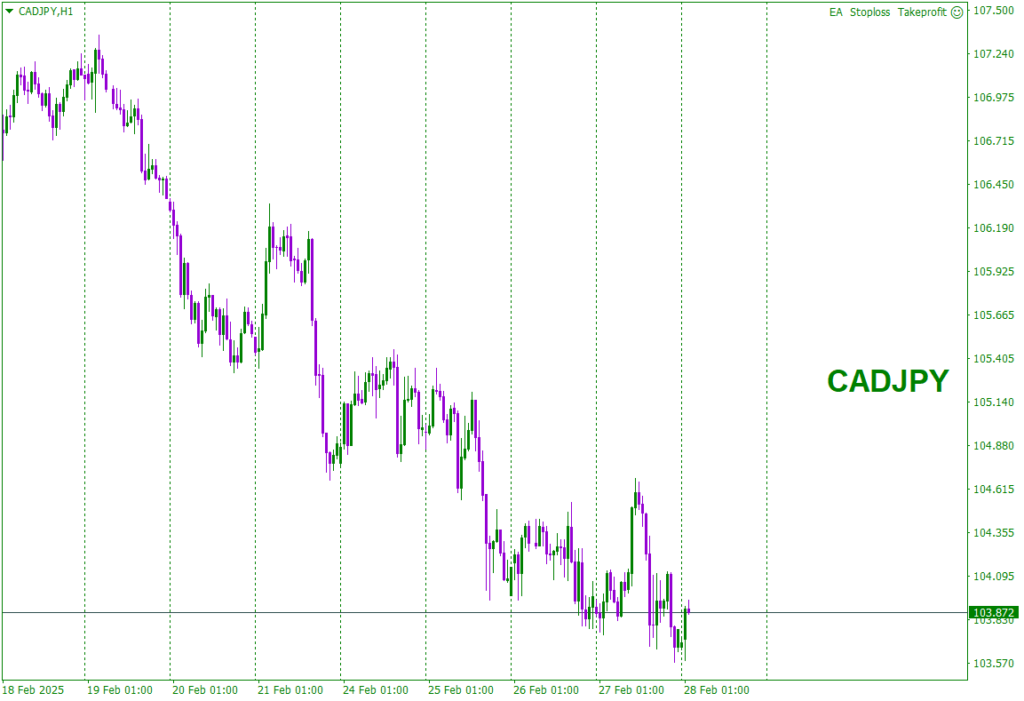

- Buy the currency with the strongest index and pair it with the weakest one. For instance, if JPY is the strongest and CAD and AUD are the weakest, focus on selling CADJPY and AUDJPY.

This approach also works for commodities, cryptocurrencies, stock indices, bonds, and more.

Special note: Pay close attention to the USD index. Only buy an asset if its value is greater than the USD index, and do the opposite if it’s lower.

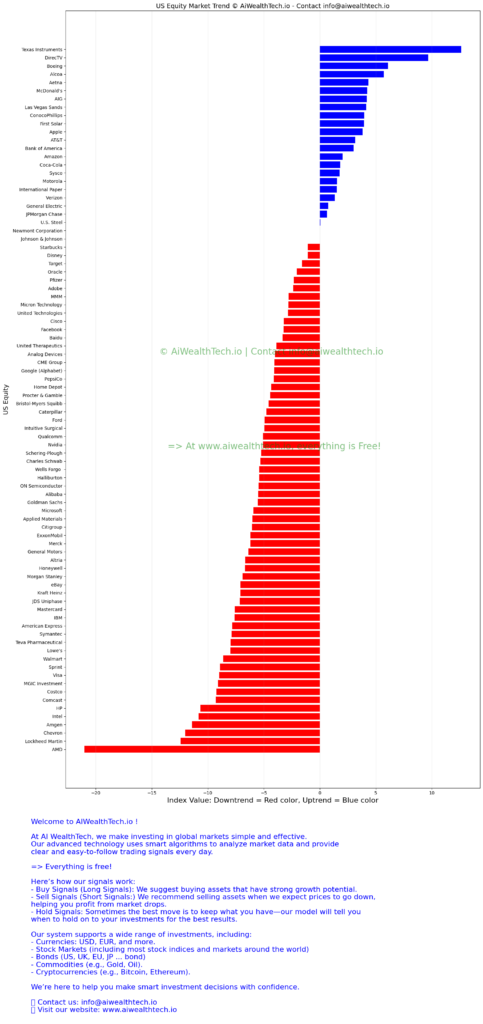

2. Stock Model

The stock model works in a similar way. It tells you:

- Which stocks are the strongest (prioritize buying),

- Which stocks are the weakest (prioritize selling),

- Which stocks have an index that’s just started rising (consider buying),

- Which stocks have an index that’s just started falling (consider selling).

Combine this with market sentiment to decide if you should focus on buying or selling.

3. Notes

- Daily Updates: These quantitative models will be updated every day at the beginning of the morning. This ensures you have the latest data to make informed trading decisions.

- Trading Plan: To achieve success in trading, it’s essential to create a thorough and well-thought-out trading plan. Once the plan is set, stick to it consistently and execute it properly.

- Risk Management: Always be prepared to cut losses quickly when a trade goes against you. This helps keep losses small. On the other hand, let your profits grow and continue running as long as the model does not indicate that the asset’s trend has reversed.

- Keys to Long-Term Success: Use low leverage to reduce risk, diversify your investments across different assets to spread out potential losses, and avoid overtrading (trading too frequently or impulsively). These practices are critical for making consistent profits over the long term.

This quantitative model can be applied to HFT trading, day trading, short-term, medium-term, and long-term strategies. If investors need model support for any investment or trading approach, please contact us via email: info@aiwealthtech.io.

Share This Page

Thank you very much ! Good luck !