VN Stock Market Outlook – Daily Update – © AI Wealth Tech | info@aiwealthtech.io – February 18, 2025

By Capital: Ranking of Market Cap Groups (from strongest to weakest):

1. Midcap

2. Larcap

3. Smallcap

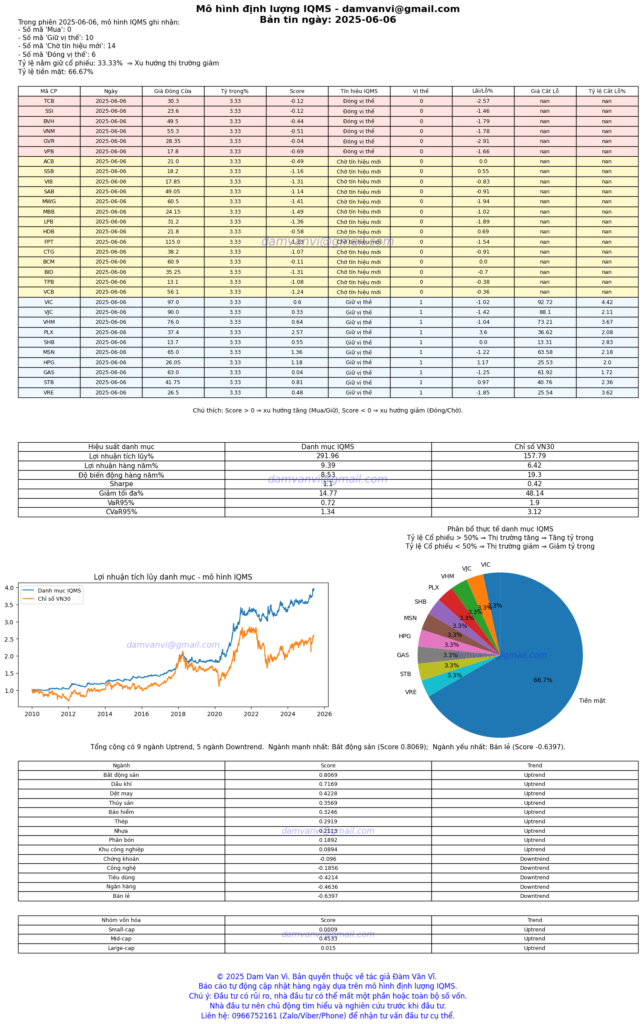

By Industry: Ranking of Industries (from strongest to weakest):

Three Strongest Industries:

1. Banking

2. Securities

3. Oil and Gas

Three Weakest Industries:

1. Retail

2. Technology

3. Consumer Staples

Recommendation:

The following capital segments are showing strength and may be considered for investment: Midcap, Larcap, Smallcap.

The following industries are strong performers and present solid buying opportunities: Banking, Securities, Oil and Gas. The following industries are underperforming and suggest a Sell recommendation: Retail, Technology, Consumer Staples.

By strategically aligning investment decisions with these insights and adopting a diversified approach, investors can enhance portfolio resilience and navigate market shifts with greater confidence. This approach empowers investors to capitalize on growth opportunities while effectively managing risk, whether targeting short-term gains or sustainable long-term growth. In line with these recommendations, buying assets that demonstrate strong performance and selling those with weaker results can further optimize returns.

This approach helps capitalize on growth opportunities while managing risks, whether for short-term gains or long-term growth. Buying strong-performing assets and selling weaker ones can further enhance returns.

Using a quantitative model ensures consistent data analysis, avoiding emotional or subjective bias. This approach allows for accurate judgment and precise asset allocation based on real market conditions and actual data, providing a solid foundation for decision-making.

Moreover, this system can be fully automated, making it an ideal solution for Hedge Funds, Trading Firms, Pension Funds, and Wealth Management, enabling seamless and efficient operations. Risk management has been integrated into the quantitative model.

The Report and Images are automatically generated by Python from the data of the IQMS-VN quantitative model.

© AIWealthTech.io | Contact: info@aiwealthtech.io

Mở tài khoản chứng khoán tại TCBS, ID partner: 105C052161

Mở tài khoản chứng khoán tại Vndirect, ID partner: 0001507556

Mở tài khoản chứng khoán tại SSI, ID partner: NC0N

Mở tài khoản Chứng chỉ quỹ Fmarket: ID partner: 007F966752161

Open account at ICmarket, ID partner : 8055

Open account at Roboforex, ID partner: axkn

Open account at Tradingview, ID partner: 149720

Do chưa đủ kinh phí cho dữ liệu nên thị trường Việt Nam chưa thể cập nhật hàng ngày. Nếu nhà đầu tư nào có nhu cầu mở tài khoản và tư vấn đầu tư giá trị hoặc đầu tư theo danh mục định lượng thì vui lòng trực tiếp liên hệ với tác giả.

Xin chân thành cảm ơn quý nhà đầu tư.